According to a current survey, the importance of various investment products is changing

The last few months on the capital markets have been very eventful: after a brilliant start to the year on the stock exchanges, there was a brief downturn at the beginning of August. ATX & Co are currently targeting old highs again. After the fastest interest rate increase cycle of all time, the ECB initiated the interest rate turnaround in June and lowered the interest rate again – as a result, the interest on deposits on many savings products also fell. How do investors in Austria deal with the dynamics on the capital markets? The “Financial Barometer 2024”, a current representative survey of 1,000 women and men in Austria by JP Morgan Asset Management, shows that a change is gradually becoming apparent when it comes to involvement in the capital market. Security-oriented forms of investment such as savings accounts, life and pension insurance as well as daily and fixed-term deposits continue to be the most frequently used investment products in Austria. Both investment funds and ETFs as well as stocks were able to further increase their share, while the popularity of savings accounts declined. Despite existing fears of threats, particularly from geopolitical instability or inflation, investors in Austria are becoming increasingly resilient in their capital market investments. Fears of a recession or a stock market crash currently only play a minor role among Austrians.

“It will probably take some time before private investors in Austria start investing on the capital market as a matter of course. But we see a clear trend: investment funds and ETFs in particular are becoming increasingly widespread. “If interest rates continue to fall, it will be exciting to see whether further funds from savings accounts as well as daily and fixed-term deposits flow into the capital market,” says Markus Sevcik, Senior Client Advisor bei J.P. Morgan Asset Management in Wien.

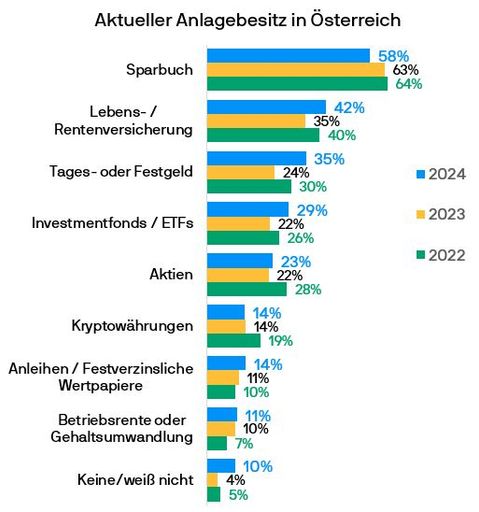

At 58 percent, the savings book remains the leader among investors, life and pension insurance have a 41 percent share, followed by daily and fixed-term deposits at 35 percent. Investment funds and ETFs increased their share by 7 percentage points to 29 percent. The difference between savings account and investment fund/ETF ownership fell to 29 percentage points in 2024 – in 2022 there was a difference of 38 percentage points, and last year it was even 41.

From Markus Sevcik’s perspective, the year 2022 was initially a turning point with the beginning of the war in Ukraine and the sharp rise in inflation – the need for security was also evident in the investment markets. “There now seems to be a certain level of resilience among investors. The headlines continue to be dominated by geopolitical trouble spots, inflation was and is one of the most frequently mentioned investor concerns and, last but not least, various economic data are weaker than expected. And yet the survey shows that people are rightly turning towards rather than away from the capital market,” explains Sevcik.

Even individual investments in stocks and bonds were able to increase again – admittedly only slightly. While 28 percent of Austrians still owned shares in 2022, their share fell by 6 percentage points last year. Currently, with an increase of one percentage point, it is back to 23 percent. In terms of risk diversification, Sevcik sees it as sensible for most private investors to rely on fund solutions instead of individual stocks. At 14 percent, investments in bonds are again more popular among investors in Austria and, with an increase of 3 percentage points, were even able to reach the same level as cryptocurrencies, whose popularity remained the same.

Geopolitical instability and inflation are particularly worrying, but recession is less so

A look at specific threat scenarios supports the thesis of resilience on the capital market. 81 percent of people in Austria consider inflation to be very threatening or threatening, while war and geopolitical instability are viewed by 82 percent of those surveyed. Although the monthly published inflation rate has been consistently below three percent since January 2024, the perceived inflation is

higher from an investor’s perspective and remains a hot topic for Austrians. The topic of populism and extremism also concerns people in Austria and is seen as threatening or even very threatening by 74 percent, as are climate change or natural disasters at 70 percent. Interestingly, only 63 percent of those surveyed consider a recession to be very threatening or threatening, and just over half of those surveyed (49 percent) fear a stock market crash – although both have already been widely reported in the media this year.

“The results of our survey show, on the one hand, that the subjective feeling of investors can differ significantly from the actual reality or from expert opinions, for example when it comes to inflation,” notes Markus Sevcik. “On the other hand, it also shows that despite the ongoing and sometimes even increasing risks, opportunities are seen on the capital market. The realization now seems to have become widespread that after price declines on the stock market, things can quickly go up again and can therefore be an opportunity to get started,” explains Sevcik. Anyone who remains loyal to an investment even in times of crisis will usually be rewarded for it in the end.

The results quoted here come from the Financial barometer Austriafrom JP Morgan Asset Management, a representative online survey via the Attest platform. Between July 10 and 14, 20024, 1,000 women and men aged 20 and over in Austria were surveyed about their savings and investment behavior. In addition to the ownership of financial products, reasons that would make investments more interesting for savers, how naturally Austrians talk about money and current perceptions of risk were examined. Further results of the survey will be published promptly.

Important instructions:

This document is promotional material. However, the information contained herein does not constitute advice or a specific investment recommendation. All forecasts, figures, estimates and statements regarding financial market trends or investment techniques and strategies, unless otherwise stated, are those of JP Morgan Asset Management as of the date the document was prepared. JP Morgan Asset Management considers them to be correct at the time of creation, but does not guarantee their completeness or accuracy. The information is subject to change at any time without prior notice. JP Morgan Asset Management also uses third party research; the resulting findings are provided as additional information but do not necessarily reflect the views of JP Morgan Asset Management. The use of the information is the sole responsibility of the reader. The value, price and return of investments may fluctuate. Past performance is not a reliable indicator of current and future performance. The fulfillment of forecasts cannot be guaranteed. JP Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. Telephone calls to JP Morgan Asset Management may be recorded for legal, training and security purposes. To the extent permitted by law, information and data from correspondence with you will be collected, stored and processed in accordance with JP Morgan Asset Management’s EMEA Privacy Policy. The EMEA Privacy Policy can be found on the following website: www.jpmorgan.com/emea-privacy-policy. Publisher in Austria: JPMorgan Asset Management (Europe) S.à rl, Austrian Branch, Führichgasse 8, A-1010 Vienna. 097n243008095043

About JP Morgan Asset Management

As part of the global financial services group JPMorgan Chase & Co, JP Morgan Asset Management aims to help clients build stronger portfolios. For more than 150 years, the company has been offering investment solutions for institutions, financial advisors and private investors worldwide and, as of June 30, 2024, managed assets worth $3.3 trillion. JP Morgan Asset Management has been present in Germany for 35 years and in Austria for more than 25 years and is one of the largest foreign fund companies in the market with assets under management of over 35 billion US dollars, combined with a strong local presence.

The extensively resourced global network of investment experts for all asset classes uses a proven approach based on in-depth research. Numerous “insights” on macroeconomic trends and market topics as well as asset allocation make the implications of current developments for portfolios clear and thus improve the quality of investment decisions. The aim is to exploit the full potential of diversification and to structure the investment portfolio in such a way that investors achieve their investment goals across all market cycles.

You can find the Austrian press website here