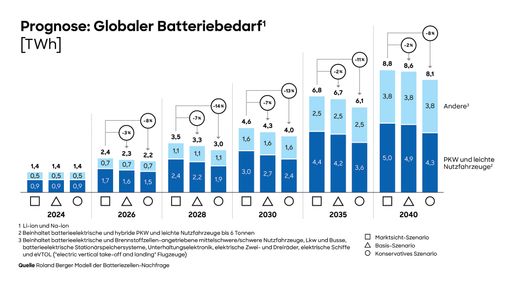

The global demand for batteries will increasingly become more than triple by 2030 and depending on the scenario to 4.0 to 4.6 terawatt hours. Technically leading producers from Asia are currently dominating the market – especially from China, where there are considerable overcapacity that ensure falling prices worldwide. This continues to put pressure on European manufacturers, which are already struggling with higher production costs and uncertainties in relation to the further round of electromobility. Nevertheless, Europe has the potential to develop into an important actor in battery production, with competitive advantages for innovations, in high -quality process technologies and the ecological footprint of the batteries. In order to catch up with the Asian market leaders, the western manufacturers have to work towards inexpensive mass production, do extensive research and work closely, even with Asian actors. The “Battery Monitor 2024/2025”, for the Roland Berger and the Chair Production of E-Mobility Components (PEM) of RWTH Aachen, provided these and other results.

- Battery Monitor 2024/2025 by Roland Berger and RWTH Aachen: Need triples up to 4.6 terawatt hours by 2030; Further doubling by 2040

- Europe’s market is characterized by the price war of Asian manufacturers; In addition, local overcapacities due to optimistic demand assumptions

- New European actors have to show that they can produce high -quality battery cells at low costs – partnerships with leading Asian competitors can make sense

“In 2024, volatility in the market for battery cells has increased significantly,” says Wolfgang Bernhart, partner at Roland Berger. “This is mainly due to uncertainties in relation to demand, because the number of electric cars sold increases more slowly than expected and is uncertain in both the US and in the EU. Manufacturer, but also makes our forecasts more complicated. “

The study authors have therefore created three forecasts for the development of the need: in a positive scenario based on the goals of the automotive manufacturers and assumes that electrification quickly progresses, the demand for batteries increases to a capacity of 4.6 terawatt hours by 2030 ( TWH) – 0.3 TWh less forecast than in last year’s “Battery Monitor” – and until 2040 to 8.8 TWh. In a basic scenario, in which the emission goals in the EU and the USA are reached despite the temporary decline in e-car sales, demand in 2030 and 2040 is 8.6 TWh. In the worst case, a negative scenario with significant delays, for example by shifting the “burner ban” in the EU, the demand in 2030 and 2040 would be 8.1 TWh.

EU manufacturers want to massively reduce the climate footprint of batteries

Since China is currently producing significantly more batteries than asking its own market, the surpluses are exported. “This leads to falling prices worldwide, which, however, cannot remain so low in the long run, because some of the suppliers and producers in China are no longer working cost -covering,” says Bernhart. Nevertheless, the drop in prices put pressure on European manufacturers that work on building their own capacities and can therefore theoretically cover more than European needs. Bernhart therefore assumes that not all announced projects are actually realized: “Currently companies have significant losses outside China. In the United States, too, the companies concerned are now extremely careful with their investment planning, which in turn carries the risk of undersupply – also driven by delays and problems in industrialization as well as a lack of economic competitiveness. “

The European battery manufacturers primarily rely on sustainability to settle from their Chinese and US competitors. So they have set themselves the goal of reducing emissions in the production of battery cells to 30 to 40 kilograms of CO2 per kilowatt hour; This corresponds to about a third to half of the current CO2 footprint of battery cells. The study authors consider this to be realistic, especially by optimizing raw material procurement, but also through innovations such as dry coating or laser drying, which lower the energy requirement of important production processes. “Even if the cost reduction is currently a priority, a smaller climate footprint of the batteries could become the competitive advantage of Europeans,” says Professor Achim Kampker, head of the RWTH chair PEM. “Especially since it is unlikely that European and North American companies can ever catch up with the Chinese lead in cost structures and raw material access.”

Many starting points for more competitiveness

The analysis of the experts from Roland Berger and the RWTH chair PEM results in a large number of levers where the industry can start to successfully grow and remain competitive. Professor Heiner Heimes, member of the PEM chair management, calls ongoing and still expected progress in cell chemistry: “Anyone who gears their production plans early on in innovations, such as new, inexpensive battery types for small and mid-range electric cars, can switch to mass production faster and can be transferred faster and benefit from the expected volumes. ” In order to build up the necessary, resilient supply chains, the study authors recommend close cooperation in particular from the European manufacturer – but not only: “Asian producers are significantly ahead of research, development and especially industrialization,” says Bernhart. “Therefore, European players should also consider partnerships with leading manufacturers.”

You can download the full study here: https://ots.de/spDFPV

About Roland Berger

Roland Berger is a worldwide leading strategy advice with a wide range of services for all relevant industries and corporate functions. Roland Berger was founded in 1967 and has his headquarters in Munich. Strategy advice is primarily known for its expertise in the areas of transformation, cross-industry innovation and increase in performance and has set itself the goal of anchoring sustainability in all your projects. In 2023, Roland Berger recorded sales of over one billion euros.

About the Chair Production Engineering of E-Mobility Components (PEM) of RWTH Aachen

The Chair “Production Engineering of E-Mobility Components” (PEM) of RWTH Aachen was founded in 2014 by “StreetScooter” co-inventor Professor Achim Kampker. In numerous research groups, the PEM team is dedicated to all aspects of development, manufacturing and recycling of battery systems, electric motors, hydrogen technologies and their respective components as well as their integration, especially in heavy commercial vehicles. A total of 76 researchers, 31 non -scientific employees and around 120 student assistants are employed at three locations. The PEM team is active in teaching as well as in nationally and internationally funded research projects and in cooperation with renowned industrial partners. The focus is always on sustainability and reduction in costs – with the aim of a complete “innovation chain” from basic research to large series production. In this context, the Chair of PEM offers the breeding ground for company outlines and mobility products, which are also networked with each other.