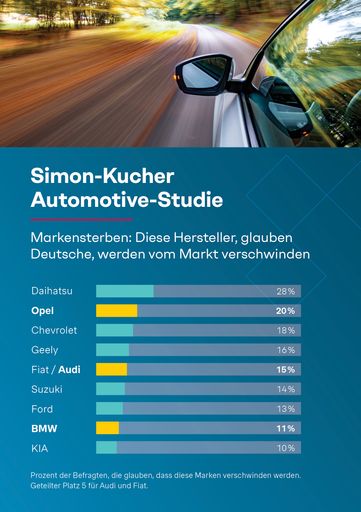

Although car purchasing budgets and purchasing mood are increasing, doubts about the future security of individual traditional brands are growing. According to the Simon-Kucher Automotive study, over half of Germans fear that established manufacturers could disappear from the market in the future. The reasons: The high dynamics in the area of e-mobility, pressure to innovate, new competitors and sustainability requirements. Opel, Audi and BMW are also in the top ten automotive manufacturers threatened by brand extinction.

- Inflation does not reduce willingness to buy: Germans’ budget for buying cars is increasing

- 53% of Germans believe that established car brands are disappearing

- Germans particularly see Opel (20%), Audi (15%) and BMW (11%) at risk from German manufacturers

- 61% see electric cars as the future; Demand increases from 52% to 56% (for premium cars to 63%)

- VW is the most popular non-premium brand in Germany, ahead of Ford and Skoda

- Willingness to pay for leasing/subscriptions is falling – probably due to price pressure from Chinese brands

Are traditional German car brands prepared for the future? The Simon Kucher Automotive study shows that 53 percent of Germans believe that individual established car brands could disappear from the market in the next few years. And this despite the fact that both the budget for the next car purchase and the mood to buy are increasing again.

Opel, Audi and BMW are particularly at risk

Fiat, Ford, Kia. The top 10 car manufacturers threatened by brand extinction affect manufacturers from all over the world. First and foremost: Daihatsu. 28 percent of Germans believe that this brand may soon disappear. But traditional German brands can also be found in the ranking. The Germans see traditional brands such as Opel (20 percent – 2nd place), Audi (15 percent – 5th place) and BMW (11 percent – 8th place) under threat.

“Without adjustment there is a risk of losing market share”

“Established brands are faced with the challenge of ensuring their relevance due to the high dynamics of electromobility, pressure to innovate, new competitors and sustainability requirements such as the ban on internal combustion engines,” emphasizes Matthias Riemer, partner at Simon-Kucher. “Without adaptation, traditional German brands are also at risk of losing market share and trust!”

VW in first place ahead of Ford and Skoda

But who will emerge as the winner from this development? In terms of brands, VW remains the most popular non-premium brand ahead of Ford and Skoda. As far as the drive is concerned, the signs point to electromobility. 61 percent of Germans see electric cars as the future. Here demand increases from 52 percent to 56 percent (for premium cars even to 63 percent). In general, the Germans are open to technology. 60 percent are considering petrol engines, 51 percent are considering plug-in hybrids, 49 percent are considering hybrids and 27 percent are considering diesel. The drive as the main purchase driver therefore takes a bit of a back seat.

Price pressure from China influences the market The Simon Kucher Automotive study, on the other hand, sees the willingness to pay for leasing/subscriptions declining. “While Germans’ car-buying mood is increasing, the leasing sector is seeing a declining willingness to pay despite increasing customer interest,” says Alexander Dietz, Senior Director at Simon-Kucher. “The main reason is the increasing competitive pressure, which is fueled by new brands from China. Established manufacturers see themselves forced to follow suit in this sales channel. Even against the existing competition.” An indication of this: 34 percent of Germans are already considering buying a Chinese car.

The majority have already decided on the brand of their next car

E-cars, pressure from increasing competition, brands under threat – can car manufacturers still change the minds of potential buyers? “Convince car buyers of a new brand in the last few meters? That’s almost impossible,” says Matthias Riemer. 60 percent of Germans have already decided on the brand of their next car. 71 percent are already sure about the type of drive. “It is all the more important for car manufacturers to position themselves for the long term and to create sustainable growth with the right strategies. The key: customer-oriented orientation in the market, implemented dynamically.”

*About the study: The representative Simon-Kucher Automotive Study was conducted in July 2024 by Simon-Kucher in cooperation with the independent market research company Dynata. 1,000 consumers in Germany were surveyed about purchasing decisions, brand perception and technological innovations.

In-depth information and infographics in print quality (currently only for media and partner companies) are available upon request. In a few weeks, the study results will be available for download on simon-kucher.com.

About Simon Kucher

Simon-Kucher is a global management consultancy with more than 2,000 employees in over 30 countries. Our focus: “Unlocking Better Growth”. We help our customers grow “better” by optimizing every aspect of their business strategy, from products and pricing to innovation, digitalization, marketing and sales. With around 40 years of experience in monetization and pricing, we are considered a global leader in pricing consulting and business growth. simon-kucher.com