Austria’s SPÖ pensioner representatives and trade unionists for private employees criticize that there would be losses of up to 50 percent in company pension schemes. However, this is a sleight of hand. Because the insured have not lost around 50 percent of their contributions; only the return they earned on their deposits has fallen. In total, you continue to receive more money than was deposited.

However, the issue raised here should draw attention to a more important systemic problem: The fact that the returns achieved have fallen is also due to conservative investments in Austria. This means that most investments are not made in the stock market, but rather in government bonds – and that was a losing proposition in times of zero interest rates. According to the Oesterreichischer Steuerbank, company pension funds invest 44 percent of their money in bonds, 38 percent in stocks and 16 percent in real estate. The mistake is not that too much money is invested in the stock market, but rather that too little money is invested.

Austria relies primarily on a greatly expanded state pension. This costs employees a lot of money: In hardly any other country do employees and employers pay more into a statutory pay-as-you-go system. In addition, billions more will have to be injected through tax money because the number of contributors to the system is becoming fewer and fewer due to demographics. There is no return at all in the pay-as-you-go system. The pension adjustments must be absorbed 1:1 by contributors and taxpayers.

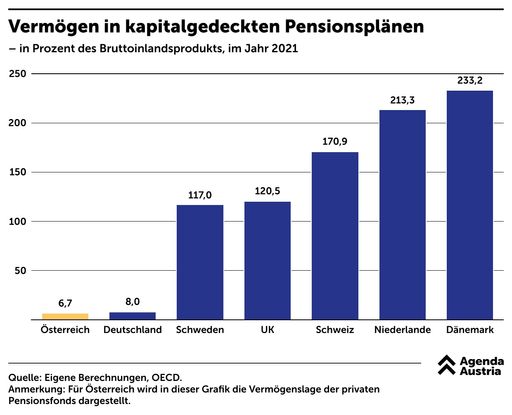

Due to demographic developments, we are placing more and more burden on the first, legal pillar. In addition to increasing the statutory retirement age – as recently requested by the Old Age Security Commission – there is a need to strengthen the company’s second pillar, which is covered by capital markets. In fact, company pension provision in Austria is not performing as well as it could.

For this purpose, a mandatory company pension system should be introduced. This should be financed in part from contributions from the first pillar. In addition, employers and employees should pay part of their gross income there. To ensure that labor costs do not rise, non-work-related taxes such as family burden equalization funds (FLAF) or contributions to housing subsidies must be eliminated and financed from the general tax pool. In addition, the current severance payment regulations should be newly integrated into the system.

The funds are to be invested on the capital market in a similar way to those in the Nordic countries. This means that pension funds can generate significantly higher returns for the insured. Broadly diversified investments such as ETFs or even those modeled on the Norwegian sovereign wealth fund significantly reduce the risk. Over a long-term investment period, as is relevant for pension provision, even price drops, such as in the financial crisis or the corona pandemic, do not cause a lasting loss in the value of the pension. Contrary to popular belief, investing in stocks is the most value-adding investment in the long term.

OTS ORIGINAL TEXT PRESS RELEASE UNDER THE EXCLUSIVE RESPONSIBILITY OF THE SENDER FOR CONTENT – WWW.OTS.AT | AAD